By Sneha S K and Sriparna Roy

(Reuters) -Shah Capital, Novavax's second-largest shareholder, is pressing the biotech's board to pursue strategic changes, including a potential sale, and warned it could launch a proxy fight if no progress is made in the next four months.

In a second letter to Novavax's board in less than a month, shared exclusively with Reuters on Wednesday, Shah Capital said it has become "increasingly disenchanted" with the company's weak COVID-19 vaccine sales.

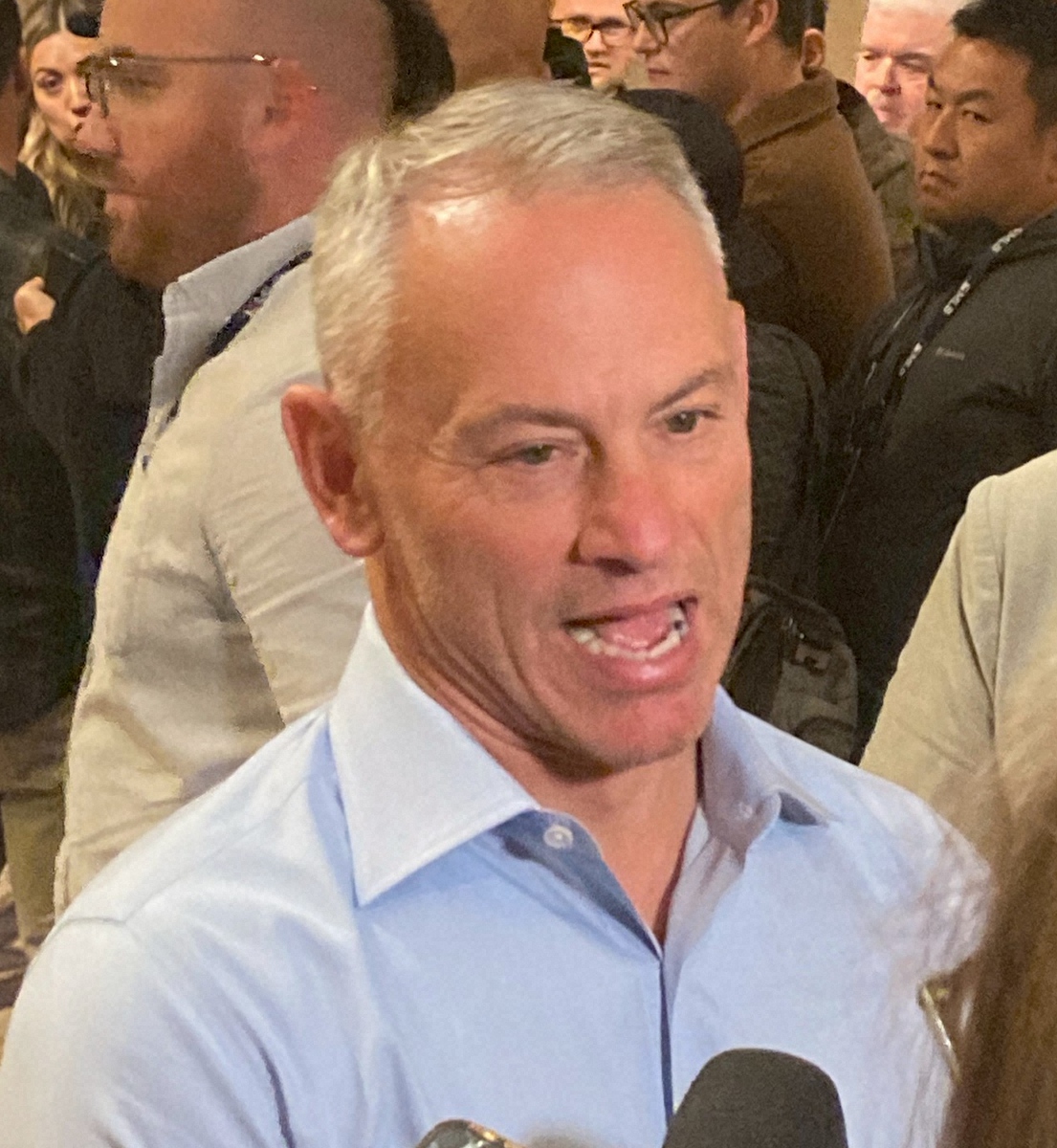

"If I don't see changes happening, and if the company doesn't follow through in the next four months, then I think that is definitely a potential for a proxy fight," hedge fund founder Himanshu Shah said in an interview.

The fund said it still believes in Novavax's science and has increased its stake to about 8.3%, up from 7.2% in October.

However, it said it remains "at a complete loss" over the disappointing sales of Novavax's protein-based COVID-19 vaccine and is frustrated by its negligible market share.

DISCONNECT BETWEEN POTENTIAL AND EXECUTION

This marks another push from the activist investor for change after it withdrew a campaign against three board directors last year, following Novavax's licensing deal with Sanofi.

"It is reasonable to question whether Novavax and its partner are exhibiting a profound lack of competence or intentionally underperforming," the letter said.

Novavax's vaccine sold about 120,000 doses as of October 31, during the 2025-26 season that started in August, versus 14.5 million doses sold in the same period by two competitors, leaving Novavax's market share at about 0.8%, the letter said.

"Despite strong underlying science and evident market need, the disconnect between potential and execution is striking," the hedge fund said in its letter.

Earlier this month, Novavax pushed back its profitability target by a year to 2028.

Novavax has a high cost base, needs to be operationally profitable next year and should run more comprehensive trials, Shah said.

Shah values the company at $5 billion to $10 billion. Novavax's market capitalization is about $1.21 billion, according to LSEG data.

The fund urged the board to immediately form a committee to evaluate a sale and hire a qualified investment bank.

Shah has previously named Sanofi, Merck, GSK and AstraZeneca as potential buyers, but said he has not contacted them.

(Reporting by Sneha S K and Sriparna Roy in Bengaluru; Editing by Tasim Zahid)

LATEST POSTS

- 1

混雑の福岡空港発着数、1時間に5回増検討を国に要請 検討委初会合(朝日新聞)

混雑の福岡空港発着数、1時間に5回増検討を国に要請 検討委初会合(朝日新聞) - 2

Disability rights activist and author Alice Wong dies at 51

Disability rights activist and author Alice Wong dies at 51 - 3

Top 15 Web-based Entertainment Stages for Individual Marking

Top 15 Web-based Entertainment Stages for Individual Marking - 4

Video Conferencing Instruments for Virtual Gatherings

Video Conferencing Instruments for Virtual Gatherings - 5

仙台育英高校サッカー部がいじめ問題で全国大会出場を辞退。弁護士の見解や代替出場の可能性は? #エキスパートトピ(下薗昌記) - エキスパート - Yahoo!ニュース

仙台育英高校サッカー部がいじめ問題で全国大会出場を辞退。弁護士の見解や代替出場の可能性は? #エキスパートトピ(下薗昌記) - エキスパート - Yahoo!ニュース

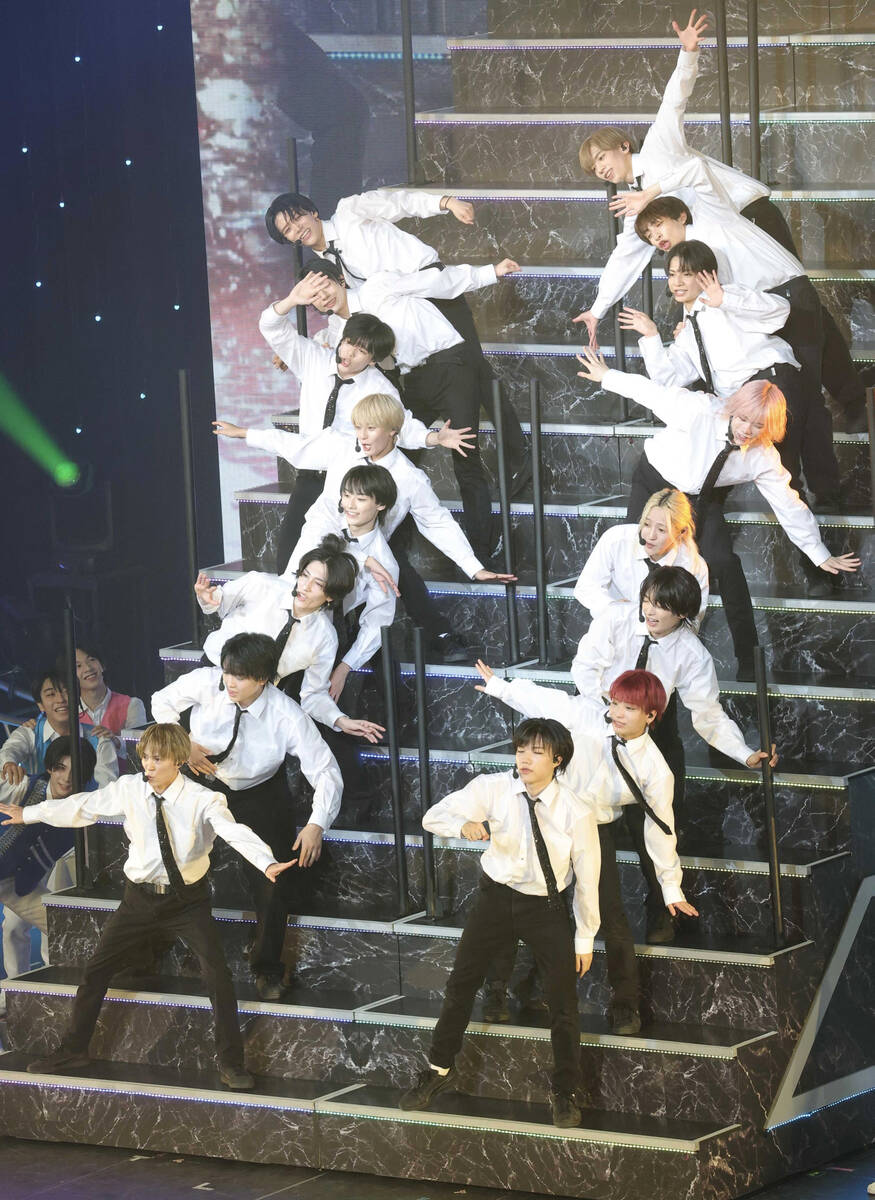

ジュニアの16人組「少年忍者」、今月末で活動終了「個人の活動に専念」…コメント全文(スポーツ報知)

ジュニアの16人組「少年忍者」、今月末で活動終了「個人の活動に専念」…コメント全文(スポーツ報知) Instructions to Pick the Right Dental Embed Trained professional: An Exhaustive Aide

Instructions to Pick the Right Dental Embed Trained professional: An Exhaustive Aide 早田ひな 大激戦の末に涙のチャンピオンズ初V!日本頂上決戦で張本美和にリベンジ【卓球 WTTフランクフルト】(テレ東スポーツ)

早田ひな 大激戦の末に涙のチャンピオンズ初V!日本頂上決戦で張本美和にリベンジ【卓球 WTTフランクフルト】(テレ東スポーツ) Vote In favor of Your Favored IT Administration

Vote In favor of Your Favored IT Administration Holiday destinations for Creature Sweethearts

Holiday destinations for Creature Sweethearts New movies to watch this weekend: See 'The Running Man' in theaters, rent 'One Battle After Another,' stream 'Nobody 2' on Peacock

New movies to watch this weekend: See 'The Running Man' in theaters, rent 'One Battle After Another,' stream 'Nobody 2' on Peacock Vote in favor of your Number one Kind of Shades

Vote in favor of your Number one Kind of Shades カブス編成本部長 今永昇太とは「完全に扉を閉めたわけじゃない」 QO受諾希望「今後も対話を続ける」(スポニチアネックス)

カブス編成本部長 今永昇太とは「完全に扉を閉めたわけじゃない」 QO受諾希望「今後も対話を続ける」(スポニチアネックス) トヨタ、新型「ハイラックス」タイで世界初公開=9代目はBEV設定 日本は26年導入へ(くるまのニュース)

トヨタ、新型「ハイラックス」タイで世界初公開=9代目はBEV設定 日本は26年導入へ(くるまのニュース)